Liz Truss becomes the UK’s 80th Prime Minister

Truss has beat Rishi Sunak by securing 57% of the votes.

What does that mean for the Pound?

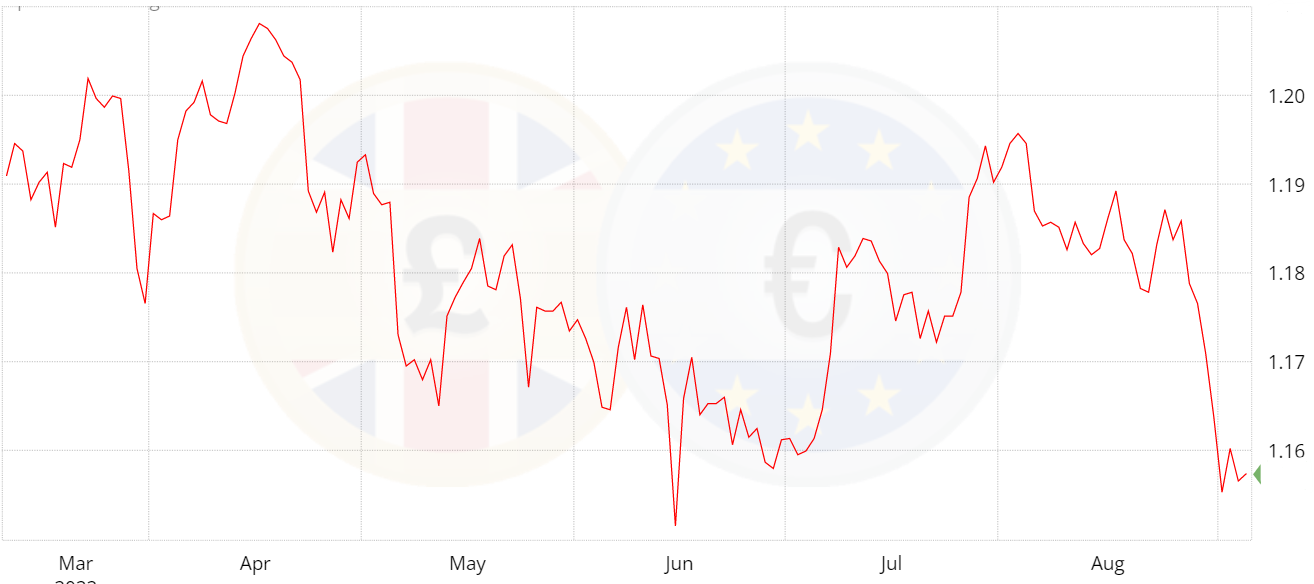

Very little at the moment. We have seen the Pound strengthen slightly against the Euro and US Dollar. It wasn’t the landslide that many predicted; however it has given the country more political stability now we have a new prime minister in place. Rising energy prices, the cost-of-living crisis and inflationary pressures will continue to put further pressure on the Pound and cause many to predict GBP/EUR to fall lower.

www.stockdio.com

Truss used her victory speech to pledge to “deliver on the energy crisis”. One way of doing this would be to freeze energy bills, but at what cost? According to business secretary Kwasi Kwarteng, there is still room for the UK to borrow more. According to the UK’s government borrowing and spending rules, the Treasury can suspend its fiscal rules in the event of a “significant negative shock to the economy.” (BBC). However, we may end up paying the price later, and will small businesses benefit from these freezes? Thousands of shops, pubs and restaurants may be forced to close due to rising energy costs unless the government steps in.

Until Truss is sworn in, starts the job officially and fully outlines her plans, we may see little movement due to her. We will know more during her update on Thursday.

Had there been a general election, the Tories knew that the Labour party could have won. Truss may decide not to call an early election giving her two years to change people’s opinion. She has a tough task ahead of her.

Meanwhile, the ECB interest rate meeting this week is of a bigger concern. They have been relatively quiet of late. It will be interesting to see their comments on how they intend to tackle inflation.

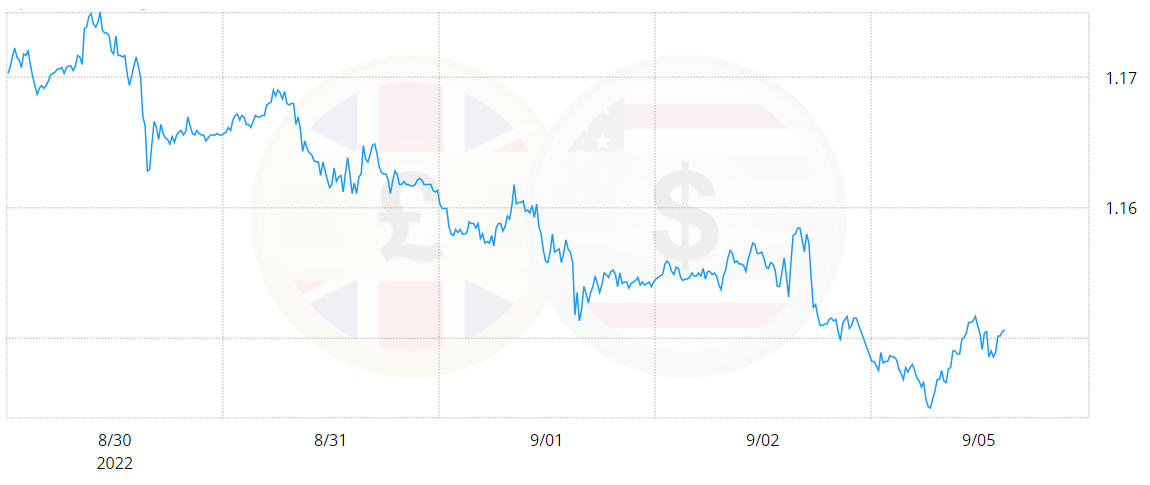

GBP/USD is also drifting lower and lower. At these levels, the US Dollar is uncompetitive and overvalued. Inflation may be coming down naturally; however, this is more to do with US Dollar strength than the consecutive interest rate hikes. Currently, the US Dollar is too strong, the FED may have to intervene to help support US exports.

www.stockdio.com

In the UK, we are also concerned about inflation. However, we could learn from the US. Instead of raising interest rates, we could strengthen the Pound, this could go a long way to help inflation.

As the next few months unfold, we will be able to help you manage all of your international payments and help you to take advantage of any rate movements.

Speak to an expert on 0203 984 0440 or email info@spartanfx.co.uk